Paying for college can be stressful, especially when you’re just beginning your undergraduate journey. Fortunately, you don’t have to navigate it alone. There are several student loan options available for undergrad students that can help cover the cost of tuition, books, housing, and other essentials.

1. Start with Federal Student Loans

First and foremost, it’s always best to begin with federal student loans. These loans are issued by the U.S. Department of Education and usually come with lower interest rates and more flexible repayment options.

To apply, you need to complete the Free Application for Federal Student Aid (FAFSA). After that, your school will use your FAFSA data to determine your eligibility for different types of federal aid.

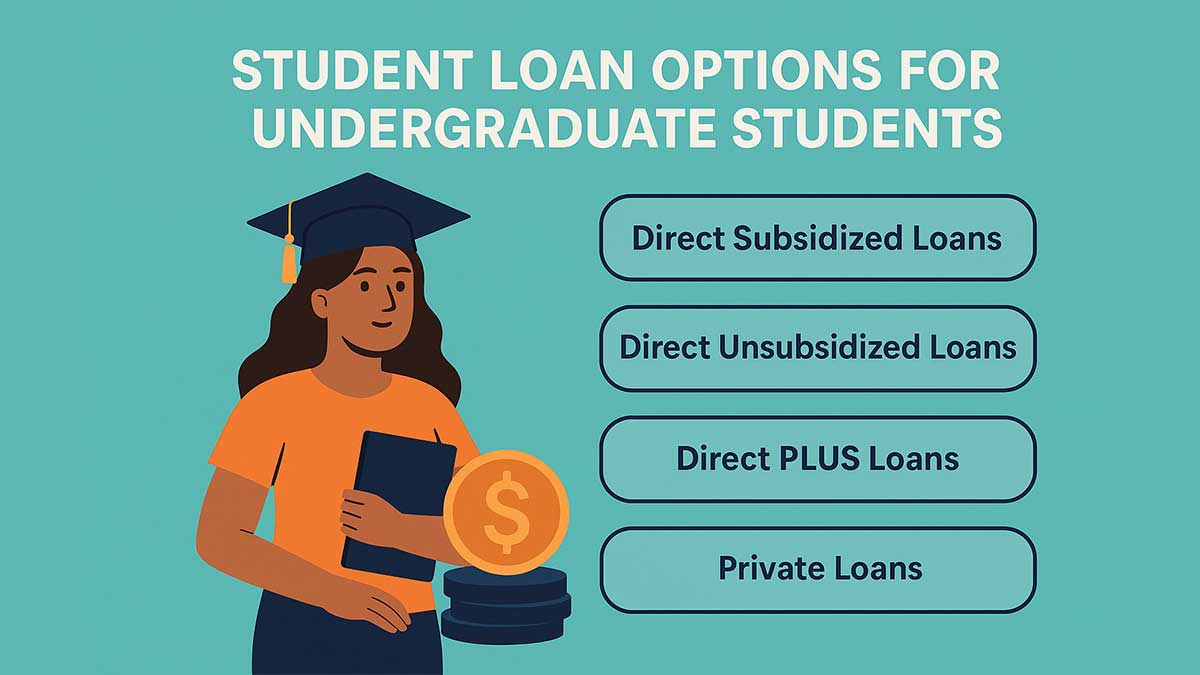

Types of Federal Loans:

- Direct Subsidized Loans: Available to undergrad students with financial need. The government pays the interest while you’re in school.

- Direct Unsubsidized Loans: Not based on need. Interest starts accruing immediately, even while you’re still a student.

- PLUS Loans (Parent PLUS): Taken out by parents of dependent undergraduate students. They require a credit check.

2. Consider Private Student Loans

Although federal loans should be your first option, you might need additional funding. In that case, you can look into private student loans offered by banks, credit unions, or online lenders.

However, it’s important to compare terms carefully. Unlike federal loans, private loans often come with higher interest rates and fewer protections. Additionally, you might need a co-signer to get the best rates.

3. Scholarships and Grants Reduce Loan Dependency

Before you borrow, explore scholarships and grants. These don’t need to be repaid, making them an excellent way to lower your need for student loans. You can find opportunities through your school, local organizations, or national databases.

4. Work-Study Programs

Besides loans and scholarships, many students benefit from Federal Work-Study jobs. These allow you to earn money while studying, which helps cover living expenses without borrowing more.

5. Loan Tips for Undergrad Students

Even if you qualify for loans, you should borrow only what you need. Moreover, always read the fine print, compare interest rates, and understand repayment plans in advance.

Download Checklist

To help you stay organized, we’ve created a free checklist covering everything from FAFSA submission to choosing the best loan option.

👉 [Download Student Loan Checklist]

Also, See: 7 Mistakes to Avoid When Taking a Loan

Leave a Reply